Page 58 - XL Axiata Integrated Anual Report 2020 ENG

P. 58

56

2020 Integrated Annual Report

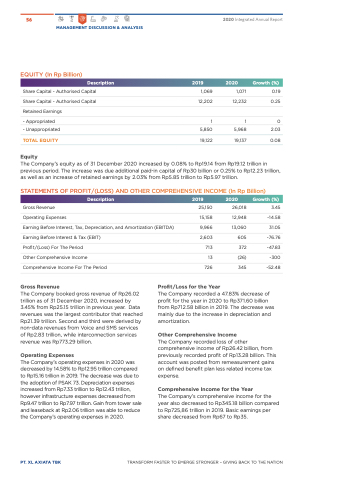

EQUITY (In Rp Billion)

MANAGEMENT DISCUSSION & ANALYSIS

Share Capital - Authorised Capital Share Capital - Authorised Capital Retained Earnings

- Appropriated

- Unappropriated

TOTAL EQUITY

Equity

1,069 1,071

12,202 12,232

1 1

5,850 5,968

19,122 19,137

Description

2019

2020

Growth (%)

0.19

0.25

0

2.03

0.08

The Company’s equity as of 31 December 2020 increased by 0.08% to Rp19.14 from Rp19.12 trillion in

previous period. The increase was due additional paid-in capital of Rp30 billion

as well as an increase of retained earnings by 2.03% from Rp5.85 trillion to Rp5.97 trillion.

STATEMENTS OF PROFIT/(LOSS) AND OTHER COMPREHENSIVE INCOME (In Rp Billion)

Description

Gross Revenue

Operating Expenses

Earning Before Interest, Tax, Depreciation, and Amortization (EBITDA) Earning Before Interest & Tax (EBIT)

Profit/(Loss) For The Period

Other Comprehensive Income

Comprehensive Income For The Period

2019

25,150

15,158

9,966

2,603

713

13

726

2020

26,018

12,948

13,060

605

372

(26)

345

Growth (%)

3.45

-14.58

31.05

-76.76

-47.83

-300

-52.48

or 0.25% to Rp12.23 trillion,

Gross Revenue

The Company booked gross revenue of Rp26.02 trillion as of 31 December 2020, increased by 3.45% from Rp25.15 trillion in previous year. Data revenues was the largest contributor that reached Rp21.39 trillion. Second and third were derived by non-data revenues from Voice and SMS services of Rp2.83 trillion, while interconnection services revenue was Rp773.29 billion.

Operating Expenses

The Company’s operating expenses in 2020 was decreased by 14.58% to Rp12.95 trillion compared to Rp15.16 trillion in 2019. The decrease was due to the adoption of PSAK 73. Depreciation expenses increased from Rp7.33 trillion to Rp12.43 trillion, however infrastructure expenses decreased from Rp9.47 trillion to Rp7.97 trillion. Gain from tower sale and leaseback at Rp2.06 trillion was able to reduce the Company’s operating expenses in 2020.

Profit/Loss for the Year

PT. XL AXIATA TBK TRANSFORM FASTER TO EMERGE STRONGER – GIVING BACK TO THE NATION

The Company recorded a 47.83% decrease of profit for the year in 2020 to Rp371.60 billion from Rp712.58 billion in 2019. The decrease was mainly due to the increase in depreciation and amortization.

Other Comprehensive Income

The Company recorded loss of other comprehensive income of Rp26.42 billion, from previously recorded profit of Rp13.28 billion. This account was posted from remeasurement gains on defined benefit plan less related income tax expense.

Comprehensive Income for the Year

The Company’s comprehensive income for the year also decreased to Rp345.18 billion compared to Rp725,86 trillion in 2019. Basic earnings per share decreased from Rp67 to Rp35.