Page 56 - XL Axiata Integrated Anual Report 2020 ENG

P. 56

54

2020 Integrated Annual Report

MANAGEMENT DISCUSSION & ANALYSIS

FINANCIAL PERFORMANCE REPORT

The discussion and analysis of the financial performance refers to the financial statements as at and for the years ended 31 December 2020 and 31 December 2019, which have been audited by Kantor Akuntan Publik Tanudiredja, Wibisana, Rintis & Rekan (a member of the PricewaterhouseCoopers networks of firms). The Company’s audited financial statements presentation and disclosure have been developed and presented in accordance with the Indonesian Financial Accounting Standards.

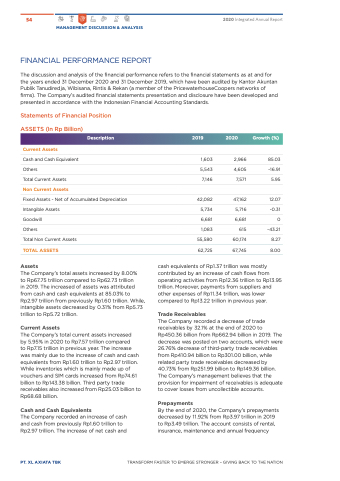

Statements of Financial Position ASSETS (In Rp Billion)

Current Assets

Cash and Cash Equivalent

1,603 2,966

Description

2019

2020

Growth (%)

85.03

-16.91

5.95

12.07

-0.31

0

-43.21

8.27

8.00

Others 5,543 4,605

Total Current Assets

Non Current Assets

Fixed Assets - Net of Accumulated Depreciation Intangible Assets

7,146 7,571

42,082 47,162

5,734 5,716

Goodwill 6,681 6,681

Others 1,083 615

Total Non Current Assets

TOTAL ASSETS

Assets

The Company’s total assets increased by 8.00%

to Rp67.75 trillion compared to Rp62.73 trillion

in 2019. The increased of assets was attributed from cash and cash equivalents at 85.03% to Rp2.97 trillion from previously Rp1.60 trillion. While, intangible assets decreased by 0.31% from Rp5.73 trillion to Rp5.72 trillion.

Current Assets

The Company’s total current assets increased

by 5.95% in 2020 to Rp7.57 trillion compared

to Rp7.15 trillion in previous year. The increase was mainly due to the increase of cash and cash equivalents from Rp1.60 trillion to Rp2.97 trillion. While inventories which is mainly made up of vouchers and SIM cards increased from Rp74.61 billion to Rp143.38 billion. Third party trade receivables also increased from Rp25.03 billion to Rp68.68 billion.

Cash and Cash Equivalents

The Company recorded an increase of cash and cash from previously Rp1.60 trillion to Rp2.97 trillion. The increase of net cash and

55,580 60,174

62,725 67,745

PT. XL AXIATA TBK

TRANSFORM FASTER TO EMERGE STRONGER – GIVING BACK TO THE NATION

cash equivalents of Rp1.37 trillion was mostly contributed by an increase of cash flows from operating activities from Rp12.36 trillion to Rp13.95 trillion. Moreover, payments from suppliers and other expenses of Rp11.34 trillion, was lower compared to Rp13.22 trillion in previous year.

Trade Receivables

The Company recorded a decrease of trade receivables by 32.1% at the end of 2020 to Rp450.36 billion from Rp662.94 billion in 2019. The decrease was posted on two accounts, which were 26.76% decrease of third-party trade receivables from Rp410.94 billion to Rp301.00 billion, while related party trade receivables decreased by 40.73% from Rp251.99 billion to Rp149.36 billion. The Company’s management believes that the provision for impairment of receivables is adequate to cover losses from uncollectible accounts.

Prepayments

By the end of 2020, the Company’s prepayments decreased by 11.92% from Rp3.97 trillion in 2019 to Rp3.49 trillion. The account consists of rental, insurance, maintenance and annual frequency