Page 57 - XL Axiata Integrated Anual Report 2020 ENG

P. 57

2020 Integrated Annual Report

55

fee comprising spectrum fees. Prepaid annual frequency fee increased by 27.83% to Rp3.14 trillion from Rp2.46 trillion in previous year. However, prepaid rental decreased 79.25% from Rp1.46 trillion to Rp303.78 billion

Non-Current Assets

Total non-current assets rose by 8.27% from Rp55.58 trillion to Rp60.17 trillion at the end

of 2020. The increase was mainly derived by

an increase of fixed assets less accumulated depreciation at 12.07% to Rp47.16 trillion compared to Rp42.08 trillion in previous period..

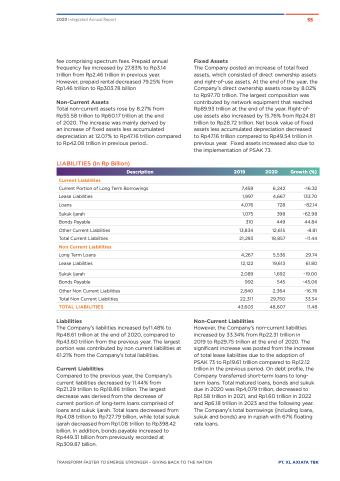

LIABILITIES (In Rp Billion)

Description

Current Liabilities

Current Portion of Long Term Borrowings Lease Liabilities

Loans

Sukuk Ijarah

Bonds Payable

Other Current Liabilities Total Current Liabilities Non Current Liabilities Long Term Loans

Lease Liabilities

Sukuk Ijarah

Bonds Payable

Other Non Current Liabilities Total Non Current Liabilities TOTAL LIABILITIES

Liabilities

The Company’s liabilities increased by11.48% to Rp48.61 trillion at the end of 2020, compared to Rp43.60 trillion from the previous year. The largest portion was contributed by non current liabilities at 61.21% from the Company’s total liabilities.

Current Liabilities

Compared to the previous year, the Company’s current liabilities decreased by 11.44% from Rp21.29 trillion to Rp18.86 trillion. The largest decrease was derived from the decrease of current portion of long-term loans comprised of loans and sukuk ijarah. Total loans decreased from Rp4.08 trillion to Rp727.79 billion, while total sukuk ijarah decreased from Rp1.08 trillion to Rp398.42 billion. In addition, bonds payable increased to Rp449.31 billion from previously recorded at Rp309.87 billion.

Fixed Assets

The Company posted an increase of total fixed assets, which consisted of direct ownership assets and right-of-use assets. At the end of the year, the Company’s direct ownership assets rose by 8.02% to Rp97.70 trillion. The largest composition was contributed by network equipment that reached Rp89.93 trillion at the end of the year. Right-of- use assets also increased by 15.76% from Rp24.81 trillion to Rp28.72 trillion. Net book value of fixed assets less accumulated depreciation decreased to Rp47.16 trillion compared to Rp49.54 trillion in previous year. Fixed assets increased also due to the implementation of PSAK 73.

2019

7,459

1,997

2020 Growth (%)

6,242 -16.32

4,667 133.70

4,076 728

1,075 398

310 449

13,834 12,615 21,293 18,857

4,267 5,536

12,122 19,613

2,089 1,692

992 545

2,840 2,364

22,311 29,750

43,603 48,607

Non-Current Liabilities

-82.14

-62.98

44.84

-8.81 -11.44

29.74

61.80

-19.00

-45.06

-16.76

33.34

11.48

TRANSFORM FASTER TO EMERGE STRONGER – GIVING BACK TO THE NATION PT. XL AXIATA TBK

However, the Company’s non-current liabilities increased by 33.34% from Rp22.31 trillion in

2019 to Rp29.75 trillion at the end of 2020. The significant increase was posted from the increase of total lease liabilities due to the adoption of PSAK 73 to Rp19.61 trillion compared to Rp12.12 trillion in the previous period. On debt profile, the Company transferred short-term loans to long- term loans. Total matured loans, bonds and sukuk due in 2020 was Rp4,079 trillion, decreased to Rp1.58 trillion in 2021, and Rp1.60 trillion in 2022 and Rp6.18 trillion in 2023 and the following year. The Company’s total borrowings (including loans, sukuk and bonds) are in rupiah with 67% floating rate loans.