Page 60 - XL Axiata Integrated Anual Report 2020 ENG

P. 60

58

2020 Integrated Annual Report

MANAGEMENT DISCUSSION & ANALYSIS

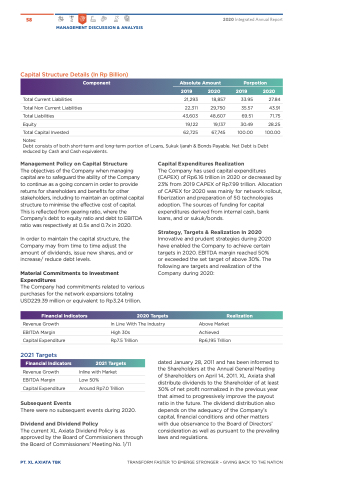

Capital Structure Details (In Rp Billion)

Total Current Liabilities

Total Non Current Liabilities

Total Liabilities

21,293

22,311

43,603

18,857

29,750

48,607

19,137

67,745

33.95

35.57

69.51

30.49

100.00

27.84

43.91

71.75

28.25

100.00

Equity 19,122

Total Capital Invested 62,725

Notes:

Debt consists of both short-term and long-term portion of Loans, Sukuk Ijarah & Bonds Payable. Net Debt is Debt reduced by Cash and Cash equivalents.

Management Policy on Capital Structure

The objectives of the Company when managing capital are to safeguard the ability of the Company to continue as a going concern in order to provide returns for shareholders and benefits for other stakeholders, including to maintain an optimal capital structure to minimise the effective cost of capital. This is reflected from gearing ratio, where the Company’s debt to equity ratio and debt to EBITDA ratio was respectively at 0.5x and 0.7x in 2020.

In order to maintain the capital structure, the Company may from time to time adjust the amount of dividends, issue new shares, and or increase/ reduce debt levels.

Material Commitments to Investment Expenditures

The Company had commitments related to various purchases for the network expansions totaling USD229.39 million or equivalent to Rp3.24 trillion.

Capital Expenditures Realization

The Company has used capital expenditures (CAPEX) of Rp6.16 trillion in 2020 or decreased by 23% from 2019 CAPEX of Rp7.99 trillion. Allocation of CAPEX for 2020 was mainly for network rollout, fiberization and preparation of 5G technologies adoption. The sources of funding for capital expenditures derived from internal cash, bank loans, and or sukuk/bonds.

Strategy, Targets & Realization In 2020

Innovative and prudent strategies during 2020 have enabled the Company to achieve certain targets in 2020. EBITDA margin reached 50% or exceeded the set target of above 30%. The following are targets and realization of the Company during 2020:

Financial Indicators

Revenue Growth

EBITDA Margin

Capital Expenditure

2021 Targets

Financial Indicators

Revenue Growth

EBITDA Margin

Capital Expenditure

Subsequent Events

Component Absolute Amount Porpotion

2019 2020 2019 2020

2020 Targets

In Line With The Industry

High 30s

Rp7.5 Trillion

2021 Targets

Inline with Market

Low 50%

Around Rp7.0 Trillion

There were no subsequent events during 2020.

Dividend and Dividend Policy

The current XL Axiata Dividend Policy is as approved by the Board of Commissioners through the Board of Commissioners’ Meeting No. 1/11

Realization

Above Market

Achieved

Rp6,195 Trillion

dated January 28, 2011 and has been informed to the Shareholders at the Annual General Meeting of Shareholders on April 14, 2011. XL Axiata shall distribute dividends to the Shareholder of at least 30% of net profit normalized in the previous year that aimed to progressively improve the payout ratio in the future. The dividend distribution also depends on the adequacy of the Company’s capital, financial conditions and other matters with due observance to the Board of Directors’ consideration as well as pursuant to the prevailing laws and regulations.

PT. XL AXIATA TBK TRANSFORM FASTER TO EMERGE STRONGER – GIVING BACK TO THE NATION